value appeal property tax services

OConnor is the largest property tax consulting firm in the US. Appealing to the State Board of Equalization.

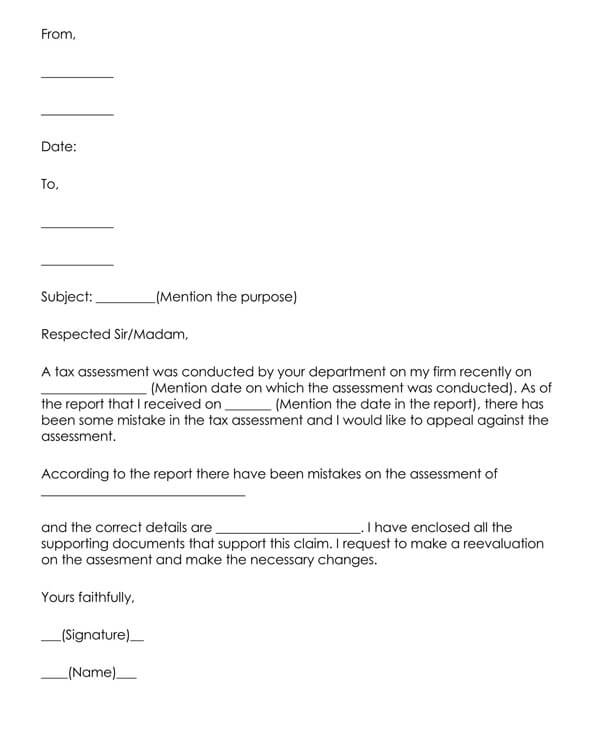

File a Protest Texas property tax appeals can be filed using the form provided by the appraisal district or click here to download the form to file a Texas Property Tax Appeal in the property tax resources section.

. If not we are happy to answer your email or phone questions. The appraisal district will send the notice of appraised value to the property owner who is required to send a. The Board of Property Tax Appeals BoPTA is comprised of independent citizens appointed by the Board of Commissioners.

How property taxes work. There are various online property value estimators. Appeals of Property Assessment.

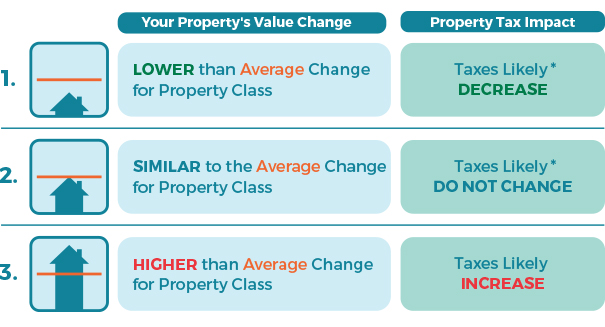

2 days agoSee property taxes are based on how much your home is worth as well as the millage rate applicable to your area. Texas homeowners should review their assessed value annually and file an appeal. We offer a powerful web based do-it-yourself tool that homeowners use to lower their property taxes.

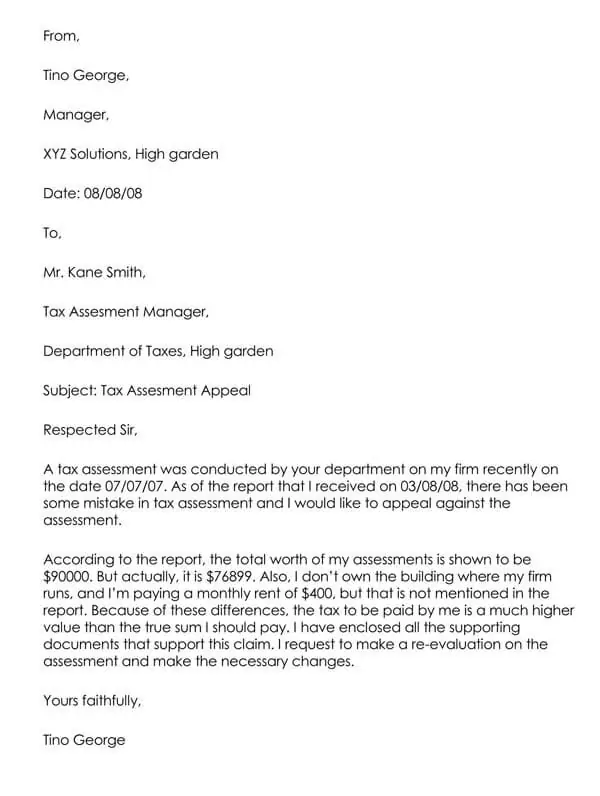

Texas Property Tax Appeals Steps to Protesting and Reducing Your Property Value Annually. If you would like to pursue a tax appeal for your property or are interested in our. Otherwise send a short letter to the chief appraiser at the.

We monitor your property values applying our knowledge of acceptable appraisal practice and Wisconsin state law regarding the valuation of real estate for assessment purposes. The professionals at Property Tax Consultants would love the opportunity to help you appeal your property tax assessment. Thus if the vehicle description owner period of tax mailing address or location of the vehicle is incorrect or the vehicle has been sold or moved from Loudoun County please call the Commissioners office at 703-777-0260 or email the Personal Property division and provide the pertinent information so the assessment may be corrected.

Unparalleled experience in property tax valuation of senior housing and multifamily housing. There is no cost to you unless we reduce your property value. The appeal deadline is fast approaching.

At Fair Assessments we have the knowledge experience and resources to successfully appeal a wide variety of residential properties. If you have value questions you may call 503 846-8826. We went live for the first time in June 2009 and have since increased our coverage area to approximately 85 of the US population.

Appeals to the state board of equalization from a local board of equalization must be filed on. For services rendered hereunder Property Owner or Corporate Officer agrees to pay Miami Tax Appeals. If you feel the appraised value of your property is too high you have the right to appeal your property value and possibly lower your property taxes.

That assessed value is whats used to calculate how much tax you owe. Zillow is one of the various options that you can use for getting an online value estimate. If you lease property and are required by the lease contract to pay the owners property taxes you may appeal the propertys value to the ARB.

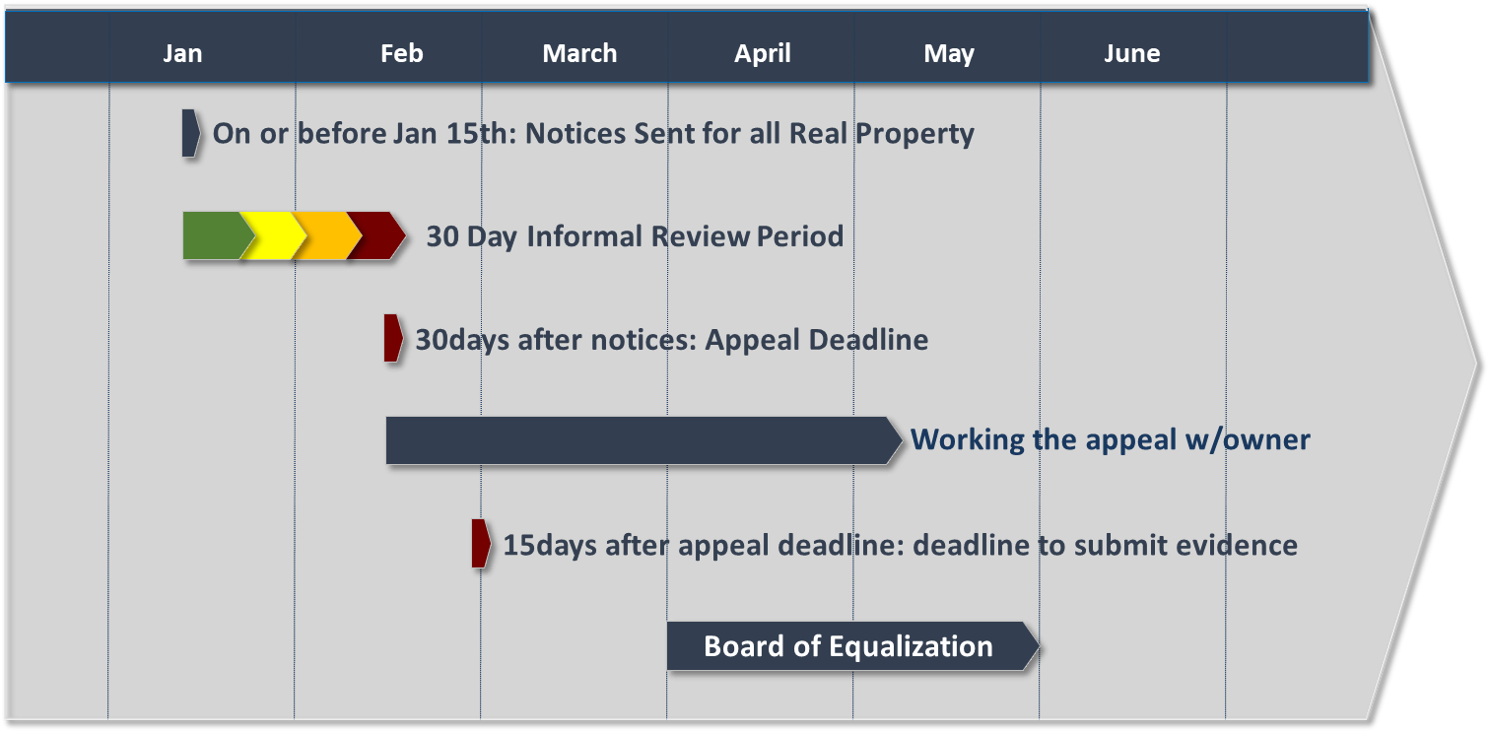

Real estate value appeals may be filed after January 1 and until the adjournment of the Board of Equalization and Review usually in May each year or within 30 days of any value change notification. In other words dont use online value estimates as your only piece of evidence if you. We file paperwork gather evidence review tax exemptions and attend hearings on your behalf.

Fair Assessments may lower your residential property taxes by reducing and capping tax assessments. Taxpayers can file appeal online using. Our expertise includes residential and commercial valuation plus tax code implications for.

You may obtain petition forms by calling 503 846-3854 or go to our Board of Property Tax Appeals BoPTA website. Comprehensive property tax protest representation and advisory service for individual and institutional investors in Texas. When to File an Appeal - Annual Valuation Notices.

Its possible to trim your property tax bill by appealing the value the taxman assigned to your home. Expertise in separating real estate value from business value in. They are authorized by law to hear appeals of your propertys value not the.

000 123. Insights gained from strong relationships with assessors. EL PASO Texas -- The deadline to appeal your homes property value is three days away.

You may make this appeal only if the property owner does not. Daniel has 31 years of real estate valuation experience as a fee. As the representative of Property Owner in an effort to reduce the 2022 assessed value of the following real property s located in Miami-Dade andor Broward County Florida.

Although sources like these can definitely help you to appeal your homes value assessment these are usually best paired with other forms of evidence. One way to lower your property tax is to show that your home is worth less than its assessed value. Contact the assessor in your county to appeal to the county board of equalization.

With limited exception a disputed assessment must first be appealed to the county board of equalization of where the property is located or it becomes final. Our full-time in-house tax consultants perform an individual analysis of your property. Your interest in Reasons To Appeal Property Taxes indicates you.

Many El Pasoans who saw their property values rise showed up at the Central. In addition to our appeals service we provide personal property form filing and property tax management services. Daniel Jones handles all residential property tax appeals.

Ready access to data that supports our analysis and recommendations. Hopefully you will find the information you are seeking about Reasons To Appeal Property Taxes. The Property Tax Appeal Process Explained.

1 day agoThe rise in expected appeals is attributed to soaring Bexar County property values. Our licensed tax consultants and administrative support team benefits home and property owners by reducing property tax assessments filing personal property renditions reviewing tax statements protesting over-assessed property values and attending informal tax hearings and appraisal review board. ValueAppeal is TurboTax for property taxes.

Here at Tax Appeal Consultants we are passionate about Real Estate Property Tax Issues Property Tax Appeals and especially Property Tax Reductions. Our service provides an easy to understand benefit saving money to a huge market US homeowners. Property Owner or Corporate Officer hereby employs Miami Tax Appeals Inc.

The average taxable property value in the county jumped to 309118 this year a 23 increase from 2021 the. Keen understanding of assessors valuation methodologies. There is an appeal process to assist property owners in presenting their concerns about property valuation.

This appeal right applies to leased land buildings and personal property. By law appeals may be filed by July 1st of each year but no later than 60 days after the mailing date listed on the Assessors Official Property Value Notice. To ensure you achieve maximum savings consider working with a property tax protest company like NTPTS.

Property taxes pay for public needs and services such as schools hospitals general funds roads and other. A millage rate is the tax dollars you pay for each 1000 in.

Timeline For Property Taxes Carver County Mn

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Assessment Appeal Letter 5 Best Examples

Property Tax Assessment Appeal Letter 5 Best Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Assessment Appeal Letter 5 Best Examples

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Real Estate Property Tax Jackson County Mo

How Do I Faqs About Appealing Assessments

Online Protest Filing Williamson Cad

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

How To Know When To Appeal Your Property Tax Assessment Bankrate

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Property Tax Assessment Appeal Letter 5 Best Examples

Property Tax Assessment Appeal Letter 5 Best Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

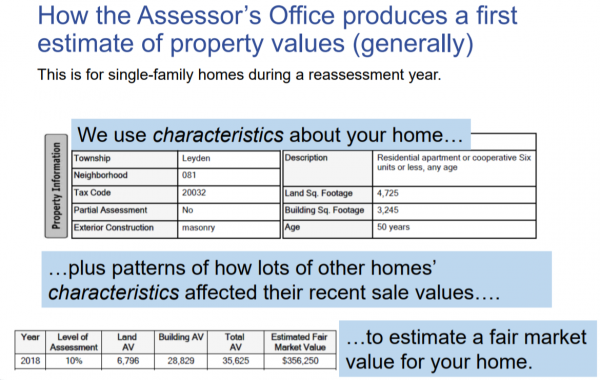

How Residential Property Is Valued Cook County Assessor S Office